Navigating the Journey to Mission-Aligned Investing

Nonprofits are increasingly seeking to take a holistic approach to mission alignment in their organizations. Historically, many considered their 5% annual distribution to be the sole contributor in achieving their mission, predominantly through grant-making activities and advocacy efforts. However, in recent years, they have considered a wider range of investment strategies as a means to move beyond the 5% and into achieving measurable environmental, social or governance (ESG) impact within their portfolios.

5 Steps to Mission-Aligned Investing

Whether commencing or expanding your organization’s approach to mission-aligned investing, you should consider the following steps in partnership with an advisor.

1. Determine Objectives

Your organization should first determine its financial and impact objectives. This may be a consultative, iterative process with both the Investment Committee and program staff coming to a consensus on how impact should be achieved within a diversified portfolio that aligns with the long-term sustainability of the organization.

Your Investment Committee should work with their advisor and program staff to draft a list of criteria they would use to establish the appropriateness of an investment opportunity in terms of mission alignment, which may include:

- Determine whether to divest, refrain from investing or pursue active ownership.

- Define preferences for opportunities with a geographic focus aligned to where the organization serves.

- Decide preferences for diverse managers and how diversity should be defined for the organization.

A bullseye framework or a checklist can capture these considerations and help visualize primary and secondary criteria. It delineates criteria for mission-alignment in the portfolio. The innermost circle represents a “bullseye” investment that meets all high priority criteria, and the outer rings represent secondary and tertiary priorities for alignment. The goal of this framework is to understand mission alignment for the portfolio holistically and to apply impact due diligence systematically.

2. Assess Market Opportunities

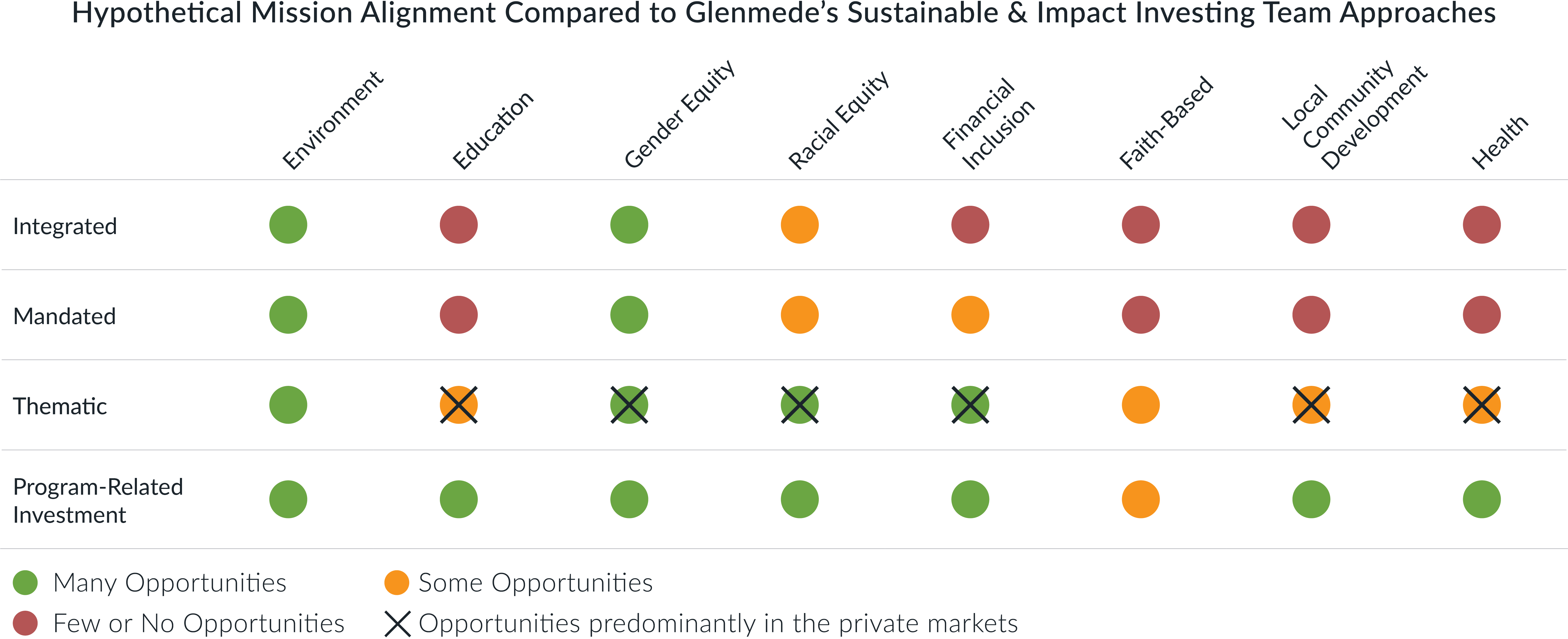

Financial and impact objectives are matched to potential frameworks and strategies across public markets, private markets and program-related investments to determine an optimal asset mix. The table below provides an example of how your organization may want to think about alignment in its portfolio holistically.

- Integrated: Explicit consideration of material ESG factors in the traditional investment decision-making processes seeking competitive risk-adjusted returns

- Mandated: Using ESG screens to avoid companies with poor ESG criteria and/or tilt toward companies with strong ESG characteristics, seeking competitive risk-adjusted returns

- Thematic: Dual goal to achieve measurable environmental or social impact and market-rate returns, seeking competitive risk-adjusted returns

- Program-related investments: High impact, place-based opportunities that may be concessionary

3. Generate Mission-Aligned Portfolio Reporting

In determining appropriate strategies for your organization’s portfolio, it’s critical to understand current exposures by generating mission-aligned reporting. This reporting should highlight metrics relevant to your organization’s impact objectives and provide a baseline view for how the portfolio is currently aligned with the stated objectives, with the expectation of generating the report annually to track progress over time.

4. Establish an Investment Policy Statement and Transition Plans

Incorporate mission alignment considerations, impact objectives and target allocations into your Investment Policy Statement (IPS). An IPS documents how your organization’s investment portfolio should be managed by you or your investment manager. Some common categories one may want to consider for a mission-aligned IPS include:

| Financial and Governance Considerations: | Mission-Aligned Considerations: |

|

|

Once the Investment Committee has included and defined its mission-aligned approach in the IPS, they should assess the extent to which the portfolio needs to be transitioned to adhere to the IPS. Transitioning to a more fully mission-aligned portfolio can be a multiyear process. Drafting a paced transition plan can allow your Investment Committee to take its time and potentially benefit from opportune market exits and entries and become comfortable with the new approach.

5. Ongoing Monitoring and Reporting

Monitoring and reporting of progress towards impact objectives should be done in conjunction with performance reviews, at minimum on an annual basis. In a transforming world, mission alignment is a continuous, iterative process that merits continuing education through review of the latest industry thought leadership and involvement with mission- related investing coalitions, conferences and partnerships for wider stakeholder engagement.

Mission Alignment in Action

Glenmede’s OCIO and Sustainable & Impact Investing teams can provide nonprofit organizations with tailored support for a customized approach to mission-aligned investing, as illustrated in the following scenario.

In 2020, a family foundation sought to mitigate climate risks and advance climate solutions while meeting their financial goals. The approach included an “invest” over divest strategy to pursue both financial and climate goals, and established impact goals and metrics to be measured on a regular basis. These goals included:

- Risk/return effect of climate-related tilt

- Increase climate-aware strategies to >50% within 4 years

- Reduce carbon emissions by >25% and water withdrawal intensity by >50%

After four years of working towards this mission alignment, the family foundation was able to achieve and exceed their goals, resulting in:

- 60% of portfolio allocated to climate-aware strategies

- 40% reduction in carbon emissions

- 70% reduction in water withdrawal intensity

- Financial goals were achieved

Getting Started

Aligning your organization’s mission with its investments can be an extensive and iterative process. By taking the proper steps and working with the right advisor, it can achieve mission-alignment to make an even greater impact.

This material provides information of possible interest to Glenmede Trust Company clients and friends and is not intended as personalized investment advice. When provided to a client, advice is based on the client’s unique circumstances and may differ substantially from any general recommendations, suggestions or other considerations included in this material. Any opinions, recommendations, expectations or projections herein are based on information available at the time of publication and may change thereafter. Information obtained from third-party sources is assumed to be reliable but may not be independently verified, and the accuracy thereof is not guaranteed. Outcomes (including performance) may differ materially from any expectations and projections noted herein due to various risks and uncertainties. Any reference to risk management or risk control does not imply that risk can be eliminated. All investments have risk. Clients are encouraged to discuss any matter discussed herein with their Glenmede representative.