Tariff Day Update

The Big Tariff Day Announcement

- The Trump administration announced a sweeping set of reciprocal tariffs yesterday. The tariffs are unprecedented in both scale and scope, well exceeding expectations from most economists and investors.

- The highlights include a base 10% tariff for all countries and country-by-country reciprocal rates ranging from 15–49%. Several Asian nations such as China, Taiwan, Vietnam and even Japan will face average duties of over 20%, while most of Europe will now face 20% tariffs.

- As of the preparation of this document, the equity market reaction has been notably negative with the S&P 500 down -2.9% from its Wednesday close.

- Unlike the market volatility observed throughout March, market weakness appears more global this time with other international markets declining alongside and in-line with the U.S. market.

Potential Economic Impact

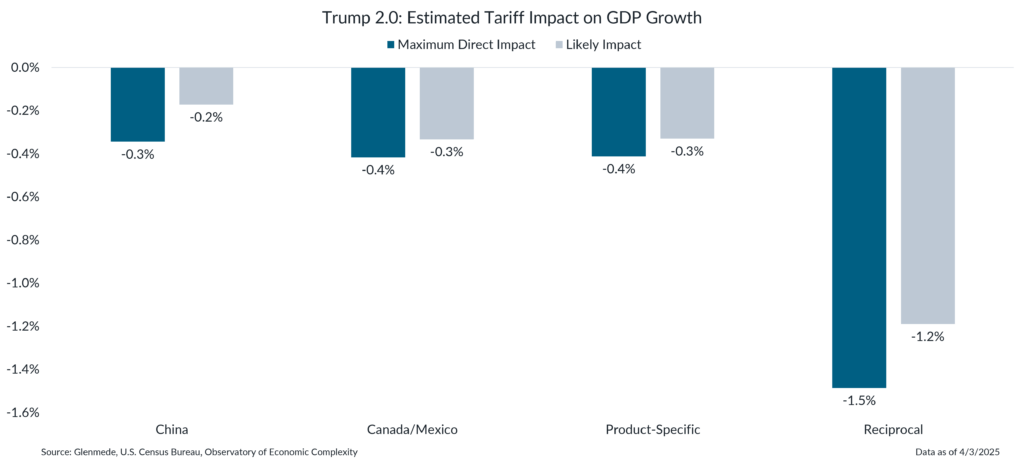

- By our estimate, the new reciprocal tariffs are expected to result in an additional headwind to economic growth of around -1.2% if implemented fully as announced.

- This would bring the total tariff-related headwind to GDP to near -2.0% given the pre-existing -0.8% headwind from the China, Canada/Mexico and product-specific tariffs already implemented by the administration.

- Given the sweeping and all-encompassing nature of these tariffs, the extent to which companies may be able to adjust supply chains and mitigate some of the impact is notably constrained.

- Such a headwind will bring near-term GDP growth closer to the 0.0% line and lift recession odds closer to a coin flip (our estimate of the probability of recession this year has risen to 40-50%).

The Tariff Path Forward

- Investors should be careful not to presume this announcement is the end to this tariff saga, as potential bends remain in the road ahead.

- The 10% universal tariff will likely face legal challenges, since it is unclear whether the President has the authority to enact such sweeping duties under the International Emergency Economic Powers Act (IEEPA).

- This may provide the impetus for Congress to accelerate and beef up the big reconciliation bill that has been in the works, which could provide some needed fiscal stimulus as an offset.

- Some nations may rush to cut their tariff rates in hopes of receiving better terms of trade, which would likely soften the economic impact.

- However, other nations may feel the need to respond in-kind with higher tariff rates of their own, fueling the fire a while longer.

Investment Strategy

- The proper strategy at this point is likely one of observation and evaluation rather than any abrupt shifts in allocations.

- Investors and economists were caught off guard by the larger-than-expected tariff announcements, leading to a market reaction that appears reasonable given changing circumstances.

- Equity markets already appear to be adjusting appropriately to a downshift in the level of GDP driven by the now-higher tariff policies.

- While the path forward remains difficult to accurately predict, reduced valuations and lower expectations create some room for eventual upside surprises as the situation develops further.

- Investors should take a patient approach to rebalancing, as markets will likely remain volatile while adjusting to new trade terms.

An aggressive approach to reciprocal tariffs could lead to an aggregate economic impact of ~2% of GDP

Estimated tariffs reflect the tariff rate applied fully to all associated imports and are shown as a percent of gross domestic product (GDP). China tariffs includes 20% country-specific tariffs as well as the revoked De Minimis exemption for imports from China and Hong Kong. Canada/Mexico includes 25% tariffs for USMCA non-compliant imports with a carveout 10% rate for Canadian energy. Product-Specific refers to tariffs on steel, aluminum, copper, lumber, automobiles and parts, pharmaceuticals, semiconductors and European alcohol. Reciprocal refers to global baseline 10% tariffs (except for Canada and Mexico) as well as higher country-specific levies that account for other countries’ tariffs, value-added taxes (VATs), currency manipulation and other non-monetary barriers to trade. The maximum direct economic impact of proposed tariffs assumes full demand destruction via a tariff-induced price shock and that tariffs are implemented fully and in isolation, with no changes to the sourcing of the imports, no other offsetting policies and no retaliatory tariffs. Likely impact accounts for offsetting factors such as reconfigured supply chains and substitution effects. Actual results may differ materially from expectations or projections.

This material provides information of possible interest to Glenmede Trust Company clients and friends and is not intended as personalized investment advice. When provided to a client, advice is based on the client’s unique circumstances and may differ substantially from any general recommendations, suggestions or other considerations included in this material. Any opinions, recommendations, expectations or projections herein are based on information available at the time of publication and may change thereafter. Information obtained from third-party sources is assumed to be reliable but may not be independently verified, and the accuracy thereof is not guaranteed. References to individual securities should not be interpreted as a recommendation to buy, hold or sell. Outcomes (including performance) may differ materially from any expectations and projections noted herein due to various risks and uncertainties. Any reference to risk management or risk control does not imply that risk can be eliminated. All investments have risk. Clients are encouraged to discuss any matter discussed herein with their Glenmede representative.