Investing in Artificial Intelligence

Balancing Innovation with Responsibility

Generative artificial intelligence (GenAI) has evolved beyond conventional data analysis to be able to create original and unique content. As companies increasingly integrate AI technology into their business models, investors may seek companies that not only excel at developing and embedding new technologies but also do so in a transparent and ethical manner.

The Path from Innovation to Realization

Generative AI has revolutionized the AI landscape. Tools such as ChatGPT, the fastest-growing consumer application in history, illustrate a significant shift in how individuals engage with AI.1 Generative AI could have a substantial impact on the economy, especially in terms of how people work. While there are concerns that AI could lead to job losses, it is more likely that jobs will evolve and adjust rather than disappear in the short term. AI technologies are expected to automate routine tasks, allowing employees to focus on more complex and creative work. The most likely industries and job categories to be affected are those with a high share of work that could be automated or augmented by generative AI, such as office and administrative support.

| Generative AI is a subset of AI technology that seeks to create complex new images, text, code and audio, often indistinguishable from human-generated content. Responsible AI is a corporate framework ensuring that AI technologies are developed and deployed in a manner that is ethical, transparent and aligns with human values, societal norms and environmental risks, safeguarding against unintended consequences. |

Investors looking to historical examples of technological revolutions, such as the steam engine and the internet, will recognize a recurring theme. While initial innovators typically provide the necessary groundwork, it is often the next wave of creative adaptors who truly transform industries. As companies adopting AI technology transition from a concentrated group to longer-term beneficiaries, the investment landscape will likely diversify. The most impactful innovations of AI may still be on the horizon, and meaningful advancements are expected to materialize gradually.

Responsible AI Considerations and the Investment Landscape

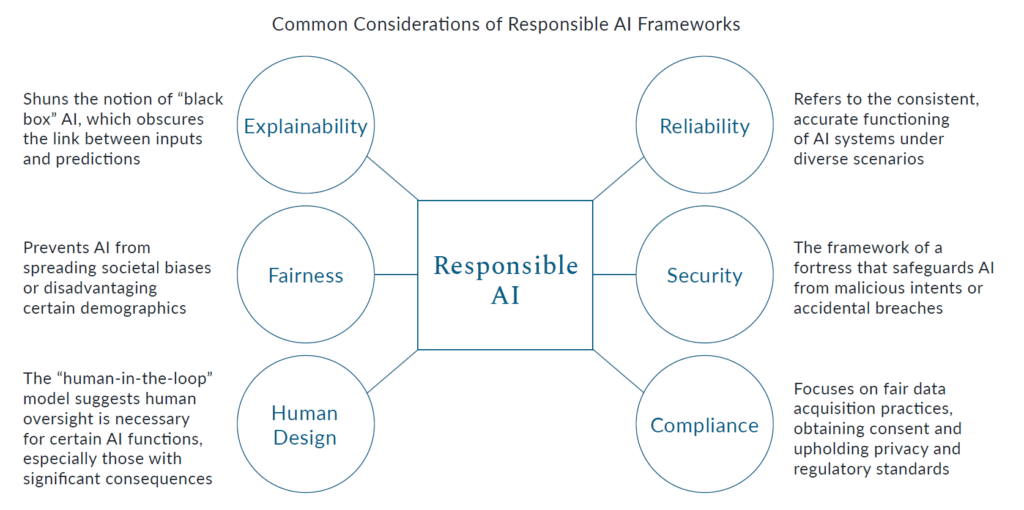

As investors realize the impact of generative AI, they will need to anticipate and adjust to the unintended consequences and risks in AI technology. Investing in AI responsibly means recognizing the material risks — from ethical issues to the environmental impact — while also seeking value-add opportunities. Several frameworks for assessing responsible AI and, they share common considerations across explainability, fairness, human design, reliability, security and compliance.

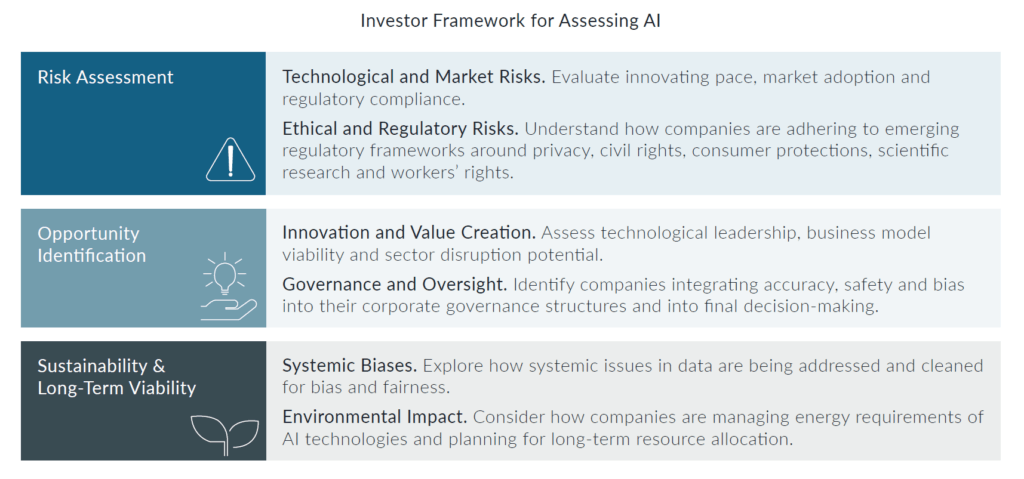

The AI landscape presents risks for consumers, stakeholders and investors, including data privacy concerns, ethical dilemmas and the potential for misinformation and disinformation. There are many opportunities for those who can navigate these challenges responsibly. Below is a summary of key considerations for investors across traditional and ethical dimensions, such as assessing risks from an ethical viewpoint, identifying opportunities that are value-additive and well-governed and digging into a company’s approach to addressing systemic biases in data.

Responsibility Across Asset Classes

Investors may seek companies that are embedding AI into their business models in a transparent and ethical way across asset classes. In the absence of regulation or a framework governing what responsible AI entails, investment strategies are emerging across public and private markets that seek to assert their own views of what constitutes investing in AI responsibly, inclusive of tilting toward business models that can be defined as responsible and screening out companies exposed to the risks associated with AI technologies. In public markets, investors might seek strategies that screen out companies failing to account for social and environmental risks associated with AI, making them susceptible to financial losses through lawsuits, regulatory actions or reputational damages. Given the reliance of energy-intensive AI

systems on data centers,2 real estate investment trusts investing in data centers are also emerging as a potential beneficiary of AI’s unfolding infrastructure. In private markets, investors might identify companies safeguarding against the risks of AI, investing in companies tackling election misinformation, intellectual property and digital identity in an era of AI-generated “deep fakes.”

Investing in AI Through a Responsible Lens

Investors are becoming increasingly discerning when assessing AI. There will be winners and losers in how companies deploy AI in their business models, evidenced by the material implications of some companies’ misuse of AI to date. Investors might consider the following approaches:

• Monitor the effect of government regulation and intervention in this space, including the emergence of the European Union’s AI Act and the October 2023 U.S. Executive Order issued by the Biden administration.

• Understand how systemic issues are deeply embedded in the data on which generative AI relies, recognizing that companies able to balance efficiency and innovation with the critical check of human-power decision-making will likely excel.

• Consider the use of shareholder engagement practices to drive change, identifying public market strategies that request data and disclosures to dig into company approaches to AI, including governance and oversight, impact assessments on stakeholders and energy usage.

As AI technology evolves, understanding the nuances of this transition — recognizing the ethical, environmental and societal implications of AI investments — will be important for investors looking to be rewarded in this space.

1 “ChatGPT Sets Record for Fastest-Growing User Base-Analyst Note.” Reuters. https://www.reuters.com/technology/chatgpt-sets-record-fastest-growing-user-base-analyst-note-2023-02-01/.

2 “Data Centers Are Sprouting Up as a Result of the AI Boom, Minting Fortunes, Sucking Up Energy, and Changing Rural America.” Business Insider, October 13, 2023. https://www.businessinsider.com/ai-data-energy-centers-water-energy-land-2023-10.

This material provides information of possible interest to Glenmede clients and friends and is not intended as personalized investment advice. When provided to a client, advice is based on the client’s unique circumstances and may differ substantially from any general recommendations, suggestions or other considerations included herein. Any opinions, recommendations, expectations or projections expressed herein are based on information available at the time of publication and may change thereafter, and actual future developments or outcomes (including performance) may differ materially from any opinions, recommendations, expectations or projections expressed herein due to various risks and uncertainties. Information obtained from third-party sources is assumed to be reliable but may not be independently verified, and the accuracy thereof is not guaranteed. In particular, information obtained from third parties relating to “ESG” and other terms referenced in this article vary as each party may define these terms, and what types of companies or strategies are included within them, differently. Glenmede attempts to normalize these differences based on its own taxonomy, but those efforts are limited by the extent of information shared by each information provider. Definitional variation may therefore limit the applicability of the analysis herein. Any reference herein to any data provider or other third party should not be construed as a recommendation or endorsement of such third party or any products or services offered by such third party. Any reference to risk management or risk control does not imply that risk can be eliminated. All investments have risk. Clients are encouraged to discuss the applicability of any matter discussed herein with their Glenmede representative.